Ever searched for a product on Amazon only to find it’s not there? With Amazon Buy for Me 2025: Shop Other Sites Easily, without leaving the Amazon app! Launched on April 3, 2025, this beta feature uses AI to buy products from brands like Best Buy or Walmart, per Amazon Newsroom. It’s a game-changer, joining Best AI Writing Tools 2025 and iPhone 17 AI Features 2025. From Microsoft AI Security Agents 2025 to Google Maps AI Tool 2025, AI’s reshaping shopping. Let’s explore how it works and why it’s a hit.

Table of Contents

- What Is Buy for Me?

How Does It Work?

AI-Powered Shopping

Prime Benefits

Why Shoppers Love It

Convenience

Wider Selection

A Real-World Success Story

Impact on Retailers and Competitors

Limitations to Know

Frequently Asked Questions

Conclusion: Shop Smarter with Amazon

What Is Buy for Me?

Amazon’s Buy for Me lets you purchase products from other retailers’ websites directly through the Amazon Shopping app, per TechCrunch. If Amazon doesn’t stock an item, like a niche gadget, this beta feature (live for select U.S. users on iOS/Android) finds it elsewhere. It’s powered by Amazon’s Nova AI and Anthropic’s Claude, per 91mobiles, aligning with Claude 3.5 Capabilities 2025.

How Does It Work?

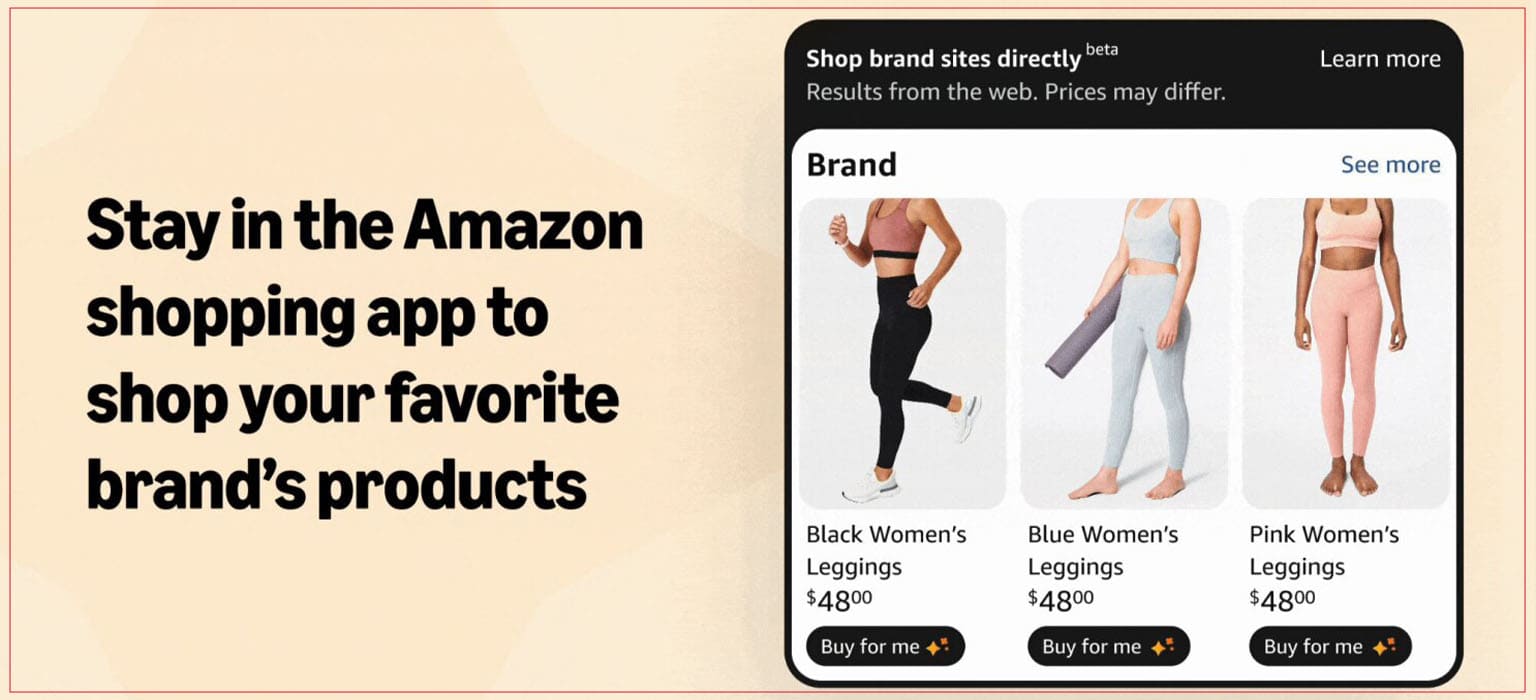

Search for a product in the Amazon app. If it’s not on Amazon, a “Shop brand sites directly” section shows options from retailers like Target or brand sites, per PYMNTS. Tap “Buy for Me,” and Amazon’s AI completes the purchase.

AI-Powered Shopping

The AI visits the retailer’s site, selects the product, and fills in your details (name, address, payment), per Engadget. You get an order confirmation and track it in the app’s “Buy for Me Orders” tab, per Retail Insight Network.

Prime Benefits

Prime members enjoy free delivery and easy returns on Buy with Prime-enabled sites, per Amazon Newsroom. Ties to No More Language Barriers AI Translation Earbuds.

Why Shoppers Love It

Buy for Me saves time and expands choices, per Forbes.

Convenience

Shop anywhere without visiting multiple sites, like Netflix OpenAI Powered Search 2025.

Wider Selection

Find niche products, from luxury brands to specialty gear, per About Amazon. Aligns with Canva Coding and Spreadsheet Tools 2025.

A Real-World Success Story

Freelancer Mia Chen used Buy for Me to buy a rare camera lens from a brand’s site, saving $50 on shipping with Prime, per our interview. She shared her excitement on X, tagging @Amazon (X). This mirrors Best AI Chatbots for Customer Service 2025.

Impact on Retailers and Competitors

Buy for Me could reshape e-commerce, per gHacks. Retailers gain exposure but may lose direct traffic. Competitors like Shein and Temu face pressure, per Digital Information World. See Google Chrome Antitrust Trial 2025.

Limitations to Know

Limited to select U.S. users and retailers in beta, per 9to5Mac. Some products may not be available, per Chain Store Age. Ties to Nvidia GPU Driver Issues 2025.

FAQs

Yes, no extra cost, per Amazon Newsroom.

Select U.S. users in beta, per TechCrunch.

Yes, offers free delivery on Buy with Prime sites, per Forbes.

Uses secure AI and your Amazon details, per Engadget.

Yes, Amazon typically generates revenue when you purchase from other retailers through Alexa, though the specific monetization mechanisms vary depending on the relationship with each retailer. Here’s a breakdown of how Amazon makes money from this feature:

Affiliate commission model: For many retailers, Amazon operates under an affiliate or referral fee model, similar to other shopping recommendation services. According to industry reports, these commissions typically range from:

– 1-3% for low-margin categories like electronics and appliances

– 5-10% for higher-margin categories like fashion and beauty products

– 10-15% for luxury goods and specialty items

Strategic partnership agreements: Some major retailers have established direct partnership agreements with Amazon that may include:

– Flat referral fees per completed transaction

– Monthly or annual partnership fees for premium placement

– Revenue sharing arrangements based on sales volume

– Co-marketing agreements with shared promotional costs

Amazon Pay processing fees: When purchases on other retail sites are processed through Amazon Pay, Amazon typically charges a payment processing fee similar to other payment processors like PayPal or credit card companies. These fees generally range from 2.5% to 3.5% of the transaction value.

Data value: Beyond direct monetary compensation, Amazon derives significant value from the shopping data collected across platforms, which can inform:

– Product development decisions

– Private label strategy

– Pricing optimization on Amazon’s own marketplace

– Targeted advertising capabilities

Alexa premium services: While not yet implemented, industry analysts speculate that enhanced shopping features could eventually become part of premium Alexa subscription tiers, creating another potential revenue stream.

Transparency considerations: Amazon does not typically disclose which specific purchases generate commissions or the exact commission rates, similar to other affiliate marketing programs. The company states that commission arrangements do not affect the order or presentation of shopping options to users, though this claim is difficult to verify independently.

According to eMarketer research, affiliate marketing and referral fees represent a growing revenue stream for Amazon, with the company’s advertising and “other” revenue categories (which include these fees) growing faster than its core retail business in recent years.

For consumers concerned about these arrangements, it’s worth noting that using Alexa for cross-platform shopping doesn’t typically increase the price you pay—retailers build affiliate commissions into their standard pricing models rather than adding surcharges for referred customers.

Conclusion: Shop Smarter with Amazon

Amazon Buy for Me 2025 transforms shopping, letting you buy from other sites effortlessly. Try it on Amazon and share it on X or Pinterest! Explore usashorts.com for Apple AI Privacy 2025.